Montgomery County Property Appraiser Md

MoCo property values increase by 12.2% in 2026 state reassessment

Commercial and residential properties in parts of Montgomery County increased in value by an average of 12.2% – slightly less than the 12.7% increase statewide – after a recent reassessment by the Maryland Department of Assessments and Taxation (SDAT). Maryland has more than 2 million residential and commercial property accounts divided into three groups.

https://bethesdamagazine.com/2026/01/06/moco-property-values-increase-by-12-2-in-2026-state-reassessment/MoCo property values increase by 12.2% in 2026 state reassessment

Commercial and residential properties in parts of Montgomery County increased in value by an average of 12.2% – slightly less than the 12.7% increase statewide – after a recent reassessment by the Maryland Department of Assessments and Taxation (SDAT). Maryland has more than 2 million residential and commercial property accounts divided into three groups.

https://bethesdamagazine.com/2026/01/06/moco-property-values-increase-by-12-2-in-2026-state-reassessment/Montgomery County Property Reassessments 2026: What DC-Area Homeowners Should Know | Pearlman Meekin & Co.

Property reassessment notices are arriving across Montgomery County, and this year’s updates are bringing meaningful increases for many homeowners. The Maryland Department of Assessments and Taxation (SDAT) reassesses properties every three years, and for 2026, all Group 2 properties, which include parts of Silver Spring, Potomac, Bethesda, Wheaton, Olney, and surrounding communities saw an average value increase of 12.2%.

https://pearlmanmeekin.com/blog/what-montgomery-countys-2026-property-reassessments-mean-for-homeowners

Montgomery County Property Reassessments 2026: What DC-Area Homeowners Should Know | Pearlman Meekin & Co.

Property reassessment notices are arriving across Montgomery County, and this year’s updates are bringing meaningful increases for many homeowners. The Maryland Department of Assessments and Taxation (SDAT) reassesses properties every three years, and for 2026, all Group 2 properties, which include parts of Silver Spring, Potomac, Bethesda, Wheaton, Olney, and surrounding communities saw an average value increase of 12.2%.

https://pearlmanmeekin.com/blog/what-montgomery-countys-2026-property-reassessments-mean-for-homeowners

Dept of Finance - County Taxes Information

County Taxes - Tax Information Dear Montgomery County Taxpayer: The Fiscal Year 2026 (FY26) operating budget for the period beginning July 1 reflects our work to prudently manage the County’s fiscal bottom line while strengthening our schools, protecting public health, improving public safety, investing in the jobs of the future, and growing the County’s tax base.

https://www.montgomerycountymd.gov/Finance/taxes/info.html

Dept of Finance - County Taxes Information

County Taxes - Tax Information Dear Montgomery County Taxpayer: The Fiscal Year 2026 (FY26) operating budget for the period beginning July 1 reflects our work to prudently manage the County’s fiscal bottom line while strengthening our schools, protecting public health, improving public safety, investing in the jobs of the future, and growing the County’s tax base.

https://www.montgomerycountymd.gov/Finance/taxes/info.html

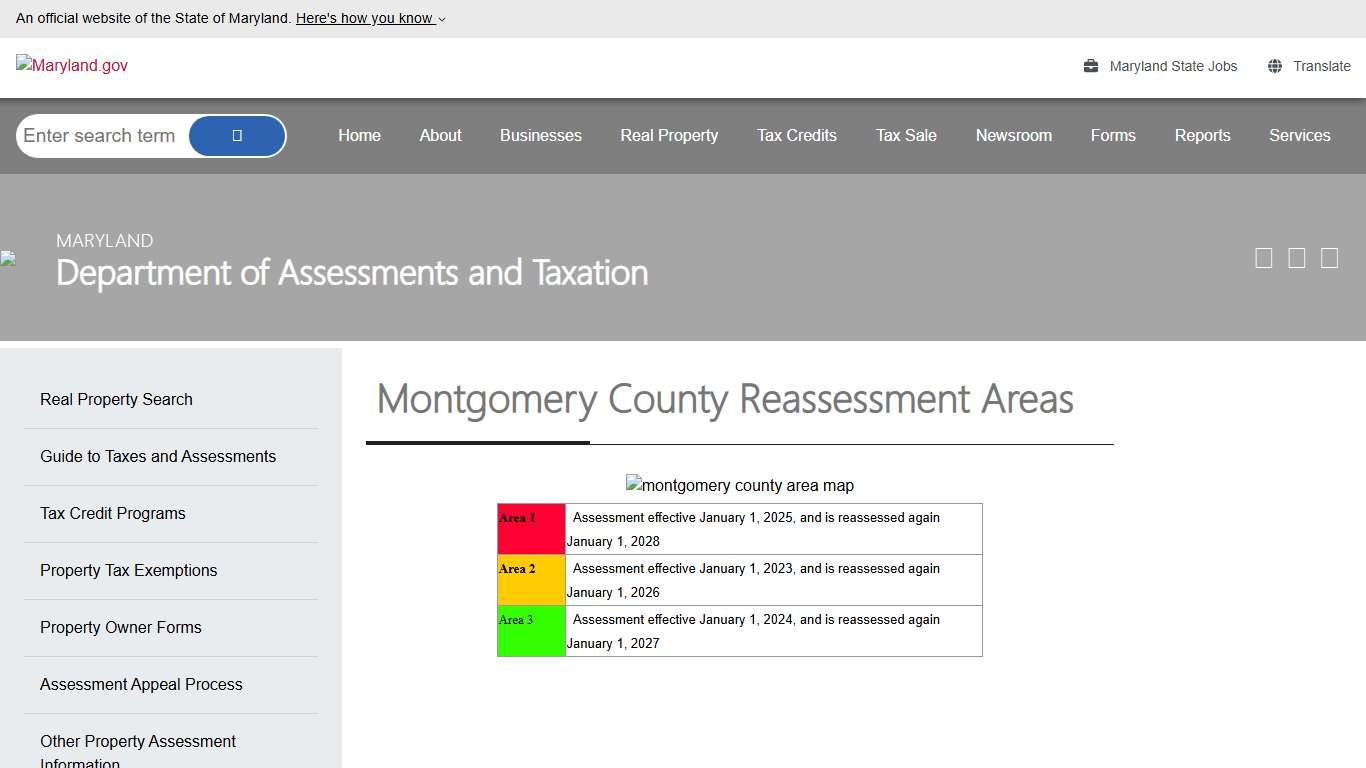

Montgomery County Reassessment Areas

The Maryland Department of Information Technology (“DoIT”) offers translations of the content through Google Translate. Because Google Translate is an external website, DoIT does not control the quality or accuracy of translated content. All DoIT content is filtered through Google Translate which may result in unexpected and unpredictable degradation of portions of text, images and the general appearance on translated pages.

https://dat.maryland.gov/realproperty/pages/montgomery-county-reassessment-areas.aspx

Montgomery County Reassessment Areas

The Maryland Department of Information Technology (“DoIT”) offers translations of the content through Google Translate. Because Google Translate is an external website, DoIT does not control the quality or accuracy of translated content. All DoIT content is filtered through Google Translate which may result in unexpected and unpredictable degradation of portions of text, images and the general appearance on translated pages.

https://dat.maryland.gov/realproperty/pages/montgomery-county-reassessment-areas.aspx

MoCo property values increase by 12.2% in 2026 state ...

r/MontgomeryCountyMD - MoCo property values increase by 12.2% in 2026 state reassessment ... Montgomery County, Maryland. News, Information ...

https://www.reddit.com/r/MontgomeryCountyMD/comments/1q5k1gb/moco_property_values_increase_by_122_in_2026/Maryland Property Tax Reassessment 2026 | Homestead Credit Guide

Maryland Property Tax Reassessment 2026: Why You Won't Actually Pay 12.7% More Maryland Property Tax Reassessment 2026: Is Your Homestead Credit Active? Are you worried about the recent news that Maryland property tax assessments are rising by an average of 12.7% in 2026?

https://www.leetessier.com/blog/-maryland-property-tax-reassessment-2026-why-you-wont-actually-pay-127-more/

Maryland Property Tax Reassessment 2026 | Homestead Credit Guide

Maryland Property Tax Reassessment 2026: Why You Won't Actually Pay 12.7% More Maryland Property Tax Reassessment 2026: Is Your Homestead Credit Active? Are you worried about the recent news that Maryland property tax assessments are rising by an average of 12.7% in 2026?

https://www.leetessier.com/blog/-maryland-property-tax-reassessment-2026-why-you-wont-actually-pay-127-more/

State property taxes show slower growth - Montgomery Community Media

When it comes to property tax for some Montgomery County homeowners, there’s good news… and bad news. This year, the Maryland Department of Assessments and Taxation reviewed property values for Silver Spring, Bethesda, Potomac, Wheaton and Olney. The good news? More than 90% of residential properties grew in value by more than 12%.

https://www.mymcmedia.org/state-property-taxes-show-slower-growth/

State property taxes show slower growth - Montgomery Community Media

When it comes to property tax for some Montgomery County homeowners, there’s good news… and bad news. This year, the Maryland Department of Assessments and Taxation reviewed property values for Silver Spring, Bethesda, Potomac, Wheaton and Olney. The good news? More than 90% of residential properties grew in value by more than 12%.

https://www.mymcmedia.org/state-property-taxes-show-slower-growth/

Montgomery County commissioners... - The North Penn Reporter | Facebook

Montgomery County adopts 2026 budget with 4-percent tax increase Montgomery County commissioners adopted a $632.7 million operating budget for 2026 with a 4 percent property tax increase.

https://www.facebook.com/lansreporter/posts/montgomery-county-commissioners-adopted-a-6327-million-operating-budget-for-2026/1260537679432269/

Montgomery County commissioners... - The North Penn Reporter | Facebook

Montgomery County adopts 2026 budget with 4-percent tax increase Montgomery County commissioners adopted a $632.7 million operating budget for 2026 with a 4 percent property tax increase.

https://www.facebook.com/lansreporter/posts/montgomery-county-commissioners-adopted-a-6327-million-operating-budget-for-2026/1260537679432269/

Montgomery County Council Approves $7.6 Billion Fiscal Year 2026 Operating Budget and Amendments to the FY25-30 Capital Improvements Program

For Immediate Release: Thursday, May 22, 2025 County property tax and income tax rates remain unchanged with a $692 property tax credit for homeowners ROCKVILLE, Md., May 22, 2025—Today the Montgomery County Council voted unanimously to approve the County’s $7.6 billion Fiscal Year (FY) 2026 Operating Budget and the $6 billion amended FY25-30 Capital Improvements Program (CIP).

https://www2.montgomerycountymd.gov/mcgportalapps/Press_Detail.aspx?Dept=1&Item_ID=47107

Montgomery County Council Approves $7.6 Billion Fiscal Year 2026 Operating Budget and Amendments to the FY25-30 Capital Improvements Program

For Immediate Release: Thursday, May 22, 2025 County property tax and income tax rates remain unchanged with a $692 property tax credit for homeowners ROCKVILLE, Md., May 22, 2025—Today the Montgomery County Council voted unanimously to approve the County’s $7.6 billion Fiscal Year (FY) 2026 Operating Budget and the $6 billion amended FY25-30 Capital Improvements Program (CIP).

https://www2.montgomerycountymd.gov/mcgportalapps/Press_Detail.aspx?Dept=1&Item_ID=47107

Did you know Maryland's latest reassessments (Group 2 for 2026) mean most Rockville & Montgomery County homes are seeing assessed values rise by about 12.7% statewide? That's higher property tax bills hitting mailboxes now. But here's the good news: New laws protect owner-occupied properties from tax sales + you might qualify for exemptions, credits, or appeals if your increase seems off.

https://www.instagram.com/p/DTLFlsnDBMc/

Did you know Maryland's latest reassessments (Group 2 for 2026) mean most Rockville & Montgomery County homes are seeing assessed values rise by about 12.7% statewide? That's higher property tax bills hitting mailboxes now. But here's the good news: New laws protect owner-occupied properties from tax sales + you might qualify for exemptions, credits, or appeals if your increase seems off.

https://www.instagram.com/p/DTLFlsnDBMc/

The Montgomery County Council approved a $7.6 billion Fiscal Year 2026 Operating Budget and amendments to the FY25-30 Capital Improvements Program focused on historic investment in education and safety-net services while holding the line on property tax and income tax rates. Council President Kate Stewart provides some details and context. | Montgomery County MD Council | Facebook

Catherine Gilberto Wallenmeyer They act like this is the best thing they ever did. Robbing from Peter to pay Paul eventually catches up. Why are none of these candidates running for CE willing to discuss the impact training M1 visa holders has on the community. - Excessive noise, … See more...

https://www.facebook.com/MontgomeryCountyMdCouncil/videos/council-approves-fy2026-operating-and-fy2025-2030-cip-budgets/550562774791598/

The Montgomery County Council approved a $7.6 billion Fiscal Year 2026 Operating Budget and amendments to the FY25-30 Capital Improvements Program focused on historic investment in education and safety-net services while holding the line on property tax and income tax rates. Council President Kate Stewart provides some details and context. | Montgomery County MD Council | Facebook

Catherine Gilberto Wallenmeyer They act like this is the best thing they ever did. Robbing from Peter to pay Paul eventually catches up. Why are none of these candidates running for CE willing to discuss the impact training M1 visa holders has on the community. - Excessive noise, … See more...

https://www.facebook.com/MontgomeryCountyMdCouncil/videos/council-approves-fy2026-operating-and-fy2025-2030-cip-budgets/550562774791598/

Tax Credit Program - Montgomery Planning

Tax Credit Programs There are several tax credit programs for the rehabilitation of historic properties in Montgomery County. To be eligible for the Montgomery County Historic Preservation Tax Credit, the property must be listed in the Montgomery County Master Plan for Historic Preservation.

https://montgomeryplanning.org/planning/historic/tax-credit-program/

Tax Credit Program - Montgomery Planning

Tax Credit Programs There are several tax credit programs for the rehabilitation of historic properties in Montgomery County. To be eligible for the Montgomery County Historic Preservation Tax Credit, the property must be listed in the Montgomery County Master Plan for Historic Preservation.

https://montgomeryplanning.org/planning/historic/tax-credit-program/

Ciresi proposes legislative solution to provide more seniors with greater financial relief from property tax, rental burdens

Ciresi proposes legislative solution to provide more seniors with greater financial relief from property tax, rental burdens HARRISBURG, Jan. 9 – At a time of increasing unaffordability – particularly in the housing market – state Rep. Joe Ciresi, D-Montgomery, stepped up with a legislative solution: H.B.

https://www.pahouse.com/Ciresi/InTheNews/NewsRelease/?id=141751

Ciresi proposes legislative solution to provide more seniors with greater financial relief from property tax, rental burdens

Ciresi proposes legislative solution to provide more seniors with greater financial relief from property tax, rental burdens HARRISBURG, Jan. 9 – At a time of increasing unaffordability – particularly in the housing market – state Rep. Joe Ciresi, D-Montgomery, stepped up with a legislative solution: H.B.

https://www.pahouse.com/Ciresi/InTheNews/NewsRelease/?id=141751

Montgomery County, MD, Rental Market & Landlord Compliance Guide (2026)

undefinedundefined At Mainstay Property Management, we’ve watched the local market transition from post-pandemic volatility into a phase best described as: Regulated Stability. Demand remains strong—driven by federal employment centers, healthcare institutions, and transit-oriented development—but the rules governing rental housing have fundamentally changed.

https://www.mainstaymanagement.com/montgomery-county-md-rental-market-landlord-compliance-guide-2026/amp/

Montgomery County, MD, Rental Market & Landlord Compliance Guide (2026)

undefinedundefined At Mainstay Property Management, we’ve watched the local market transition from post-pandemic volatility into a phase best described as: Regulated Stability. Demand remains strong—driven by federal employment centers, healthcare institutions, and transit-oriented development—but the rules governing rental housing have fundamentally changed.

https://www.mainstaymanagement.com/montgomery-county-md-rental-market-landlord-compliance-guide-2026/amp/